The FUNDAMENTAL ADVISORS LP Profile

The FUNDAMENTAL ADVISORS LP is comprised of investment advisers registered with the U.S. Securities and Exchange Commission. They provide advisory services to Public, Private, and Sub Funds.

It has been registered with the SEC for 12 years and consists of :

1

filing Adviser

that disclose

filing Adviser

that disclose

$3.96 bn

in regulatory assets under

management, a change of

1.5% over the last

12-months

in regulatory assets under

management, a change of

1.5% over the last

12-months

It reports 38 FTE's

a change of 2 Investment professionals and -1 non-Investment professionals

since 2023-03-31

a change of 2 Investment professionals and -1 non-Investment professionals

since 2023-03-31

Their primary address is

745 Fifth Ave 25th Floor, New York

New York, United States and it lists

one additional office

address.

745 Fifth Ave 25th Floor, New York

New York, United States and it lists

one additional office

address.

Request a Convergence Portal demo for full access to all profiles and underlying data.

With Convergence's Portal you gain an unobstructed view of all traditional and alternative asset class activity across 13 client types, 1,000+ institutional investors, 40,000+ fund managers, 285,000+ funds, 300,000+ portfolio companies, and 5,000+ service providers.

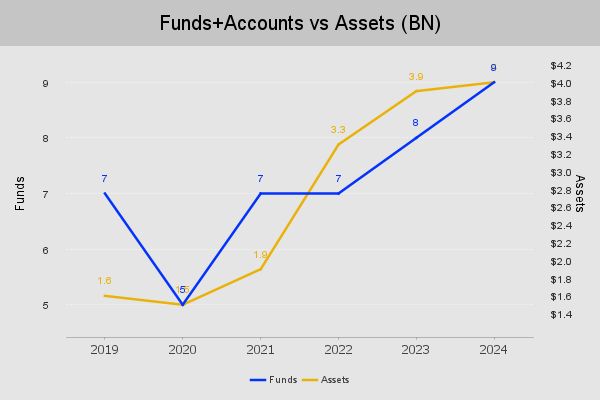

Funds & Assets

| Type of Accounts | # | Assets (BN) |

|---|---|---|

| High Net Worth Investors | ||

| Individual Investors | ||

| BDCs | ||

| Public, Private, and Sub Funds | 6 | $3.96 |

| Undisclosed | ||

| Total Accounts and Assets | 9 | $3.96 |

| Fund Type | # | Assets(BN) |

|---|---|---|

| Hedge Fund | ||

| Venture Capital Fund | ||

| Securitied Asset | ||

| Private Equity Fund | ||

| Real Estate Fund | ||

| Liquidity Fund | ||

| Other (hybrid) Fund | ||

| Sub Fund | ||

| Total Funds And Assets | 6 | $3.96 |

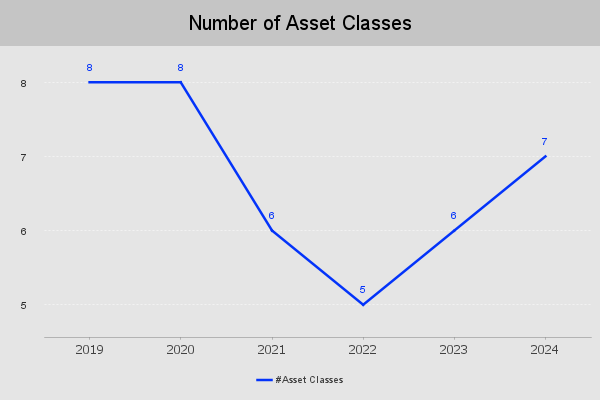

Asset Classes

| Major Asset Classes | Adviser 1 |

|---|---|

| Derivatives | Y |

| Energy | Y |

| Fixed Income-Other | Y |

| Fixed Income-Private | Y |

| Fixed Income-Public | Y |

| Public Equity | Y |

| Real Estate | Y |

| Unique Asset Classes | 7 |

Filing Advisers

A “filing adviser” is an investment adviser registered with the SEC that files a single umbrella registration on behalf of “Relying Advisers.”

Relying Advisers

FUNDAMENTAL ADVISORS LP controls 0 Relying Advisers

A “relying adviser” is an investment adviser eligible to register with the SEC that relies on a filing adviser to file (and amend) a single umbrella registration on its behalf. For a group of private fund advisers that operate as a single advisory business to qualify for Umbrella Registration, they must meet the following five requirements.

- The Filing Adviser and each Relying Adviser advise only private funds and/or “qualified clients” in separately managed accounts that are otherwise eligible to invest in the private funds advised by the Filing Adviser or a Relying Adviser and whose accounts pursue investment objectives and strategies that are substantially similar or otherwise related to those private funds.

- The Filing Adviser’s principal office and place of business is in the United States, and all of the substantive provisions of the Advisers Act and rules apply to the Filing Adviser and each Relying Adviser.

- Each Relying Adviser, its employees, and persons acting on its behalf are subject to the Filing Adviser’s supervision and control.

- Each Relying Adviser’s advisory activities are subject to the Advisers Act and rules, and subject to SEC examination.

- The Filing Adviser and each Relying Adviser operate under a single code of ethics and written policies and procedures adopted and implemented in accordance with rule 206(4)-7 of the Advisers Act and administered by a single chief compliance officer in accordance with the rule.

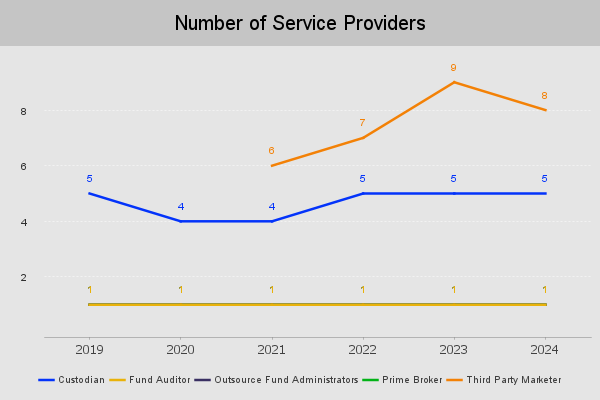

Service Providers

| Type of Service Provider | #SPs | #Funds | Asset(BN) |

|---|---|---|---|

| Outsource Fund Administrators | 1 | ||

| Fund Auditor | 1 | ||

| Prime Broker | 1 | ||

| Custodians | 5 | ||

| Third Party Marketer | 8 | ||

| Outsourced Compliance Firms | 0 | ||

| Inhouse Compliance | 0 | ||

| Totals | 16 | 23 | $35.19 |

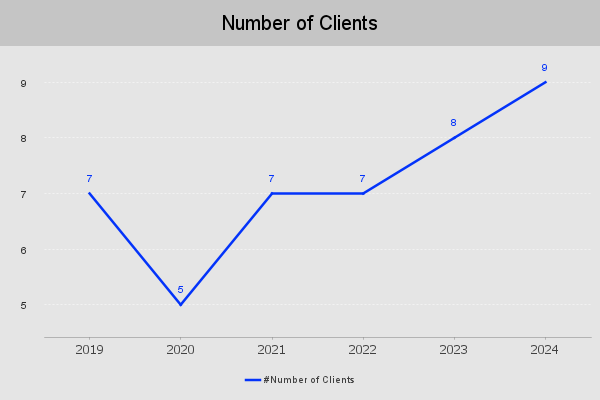

Type of Clients

| Type Of Client | 2024 |

|---|---|

| Individuals | |

| High Net Worth Individuals | |

| Banking of Thrift Institutions | |

| Investment Companies (IC) | |

| Business Development Companies (BDC) | |

| Pooled Investment Vehicles (Not IC or BDC) | |

| Pension and Profit Sharing Plans-Private | |

| Government Entities and Pension Plans | |

| Charitable Organizations | |

| Other Investment Advisers | |

| Insurance Companies | |

| Sovereign Wealth Funds and Foreign Institutions | |

| Corporations or Other Businesses | |

| Other: | |

| Total |

| Sample of 3 Known Investors | Assets |

|---|---|

Fund Strategies

| Fund Strategy All or By Adviser | Type | Yes/No | Funds | Asset(BN) |

|---|---|---|---|---|

| Distressed Debt | Yes | |||

| Equity | Yes | |||

| Total Fund Strategies | 2 | 6 | $3.96 |

Key Control Staff and Headcount

| Name | Title | Telephone | Asset Class | |

|---|---|---|---|---|

| Laurence L. Gottlieb | Chief Executive Officer | Not Available | ||

| Robert Leonard Weiss | Chief Financial Officer | Not Available | ||

| Justin Michael Vinci | Chief Operating Officer | Not Available | ||

| Jennifer Michelle Lin | Chief Compliance Officer | Not Available | ||

Business Complexity/Risk

| Function | # Factors | # High Complexity |

|---|---|---|

| Operational | 21 | |

| Compliance | 17 | |

| Vendor | 23 | |

| Regulatory Event | 2 | |

| Human Capital | 5 | |

| Totals | 68 | 12 |

Top 5 13F Positions

Data not applicable or was not provided by the filing Manager.

Regulators

| Name of Regulator | Acronym | Country | Yes/No | #Advisers | #Funds | #Affiliates |

|---|---|---|---|---|---|---|

| Commodity Futures Trading Commission | United States | Y | ||||

| Securities And Exchange Commission | United States | Y | ||||

| Totals | 2 | 2 |

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.