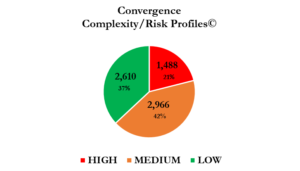

Investment and business model complexity drives operating risk[1] and the work required of Institutional Investors, Administrators and their Auditors to monitor and support them is getting tougher based on new research conducted by Convergence. The results are somewhat startling in that 63% of all Managers profiled carry a medium-to-high risk operational profile, with 21% carrying a “high” complexity/risk profile. Convergence examined and measured operating risk across 7,064 Alternative Managers and determined that Managers with a “high” complexity/Risk Profile manage $8.9 trillion in private fund assets. The most common strategies among these Managers that are Multi-Strategy (420), Private Equity (269), Equity (199), and Fund of Funds (158). Hedge Funds represent roughly 50% of private fund types managed by these Managers, with Private Equity funds at 25%.

[1] The risk of loss resulting from inadequate or failed internal processes, people and systems or from external events.

![Single Post [Template] Single Post [Template]](https://www.convergenceinc.com/wp-content/uploads/2019/09/sean-pollock-PhYq704ffdA-unsplash-1.png)