Historically, Advisors to Private Equity funds performed fund accounting and administration functions in-house at a much higher rate than Advisors to Hedge funds. The classic reasons for this have included the inherent complexity, cost and risk inherent in Private Equity fund accounting and administration. Meaning, the Managers believe that they can do this work better and at a lower cost than fund administrators. In fact, this has been true. Yet something is changing in this segment of the fund administration market worthy of your review.

Convergence’s database tracks the private fund Administrators for over 17,000 Advisors and their alternative asset funds. In a recent review we determined that currently 8% of hedge fund assets, in contrast to 62% of private equity fund assets, are self-administered, illuminating the stark disparity in back-office practices for these fund types.

The market for hedge fund administration is more established and crowded and, as we have seen is in the throes of consolidation as more firms of all sizes sell-out to larger competitors. Recent examples of this include SS&C’s buying the Citibank and Wells Fargo books and Mitsubishi’s acquisition of UBS’s book. However, we are starting to see the beginning of similar industry consolidation in the Private Equity fund administration market, where larger Administrators are starting to acquire smaller firms with private equity expertise to increase their presence in this massive and untapped market segment. With $1.9 trillion in 9,849 private equity funds, the revenue potential is large. Convergence estimates the revenue potential in the Private Equity market currently self-administered may be worth between $1.2bn and $2bn in annual fees. In an industry as competitive as Fund Administration, who is going to step-up and commit themselves to the Private Equity play?

Sanne Trust Company is clearly one market player stepping in aggressively as evidenced by their recent purchase of private equity specialist FLSV Fund Administration for reportedly $65 million, a deal set to be completed at the end of November. Factoring in this acquisition and their growth since the beginning of the year, Sanne has increased its’ total administered private fund assets by 83%, reaching $63 billion[1]. This purchase makes them a top player among PE administrators, jumping from 53rd to 7th in Convergence’s Monthly AUM rankings.

Table 1 shows a 3-year view of the Top 10 Private Equity Administrators. Sanne’s acquisition of FLSV moves them to # 7 in our 9/30/2016 Ranking and Sanne appears well positioned to compete with the PE industry leaders with the technology and expertise gained from FLSV. The Administrators highlighted in yellow have gained the greatest share of the Private Equity Market over the 3-year period.

Table 1

Sanne’s acquisition is also well-timed. Convergence found other evidence in its database supporting the view that Self-Administration in the PE market is beginning to move to independent Administrators.

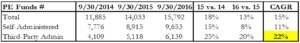

Table 2 shows Private Equity funds and their choice of Administrator over a 3-year period. While total PE funds grew at a 15% CAGR, the number of funds serviced by independent Administrators grew by a 22% CAGR and funds choosing self-administration grew by 11% CAGR.

Table 2

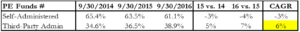

Table 3 shows a similar view over 3 years but measured in private equity gross asset value. The gross asset value held by self -administered funds declined by a -3% CAGR while assets administered by independent Administrators grew by a 6% CAGR.

Table 3

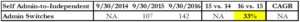

Table 4 shows the number of private equity funds that “switched” from self-administration to independent Administrators over the 2015-2016 period. These types of switches were up 33%, year-over-year.

Table 4

Conclusion

The long awaited movement of Private Equity Funds from Self-Administered to independent Administrators has officially begun!

The Sanne Trust Company purchase of FLSV and the emergence of traditional hedge fund Administrators like Citco into the market for private equity fund accounting and administration is further evidence of the trend that Convergence has observed in its database. Private Equity funds are moving their fund accounting and administration work to independent Administrators in increasingly larger numbers. This bodes well for this highly competitive industry. Pay close attention to Convergence’s Monthly Administrator League tables Convergence’s Monthly AUM rankings (click here) to see who is winning and losing in this fast growing segment of the market.

The question that remains is when will Venture Capital funds begin a similar move?

For more information on Convergence, this report and our analytical and research products please go to our website at www.convergenceinc.com or call John Phinney @ 203-956-4824 or George Evans @ 215-704-7100.

[1] This figure represents SEC Registered Funds

![Single Post [Template] Single Post [Template]](https://www.convergenceinc.com/wp-content/uploads/2019/09/sean-pollock-PhYq704ffdA-unsplash-1.png)